Digital lending software, with proven ROI

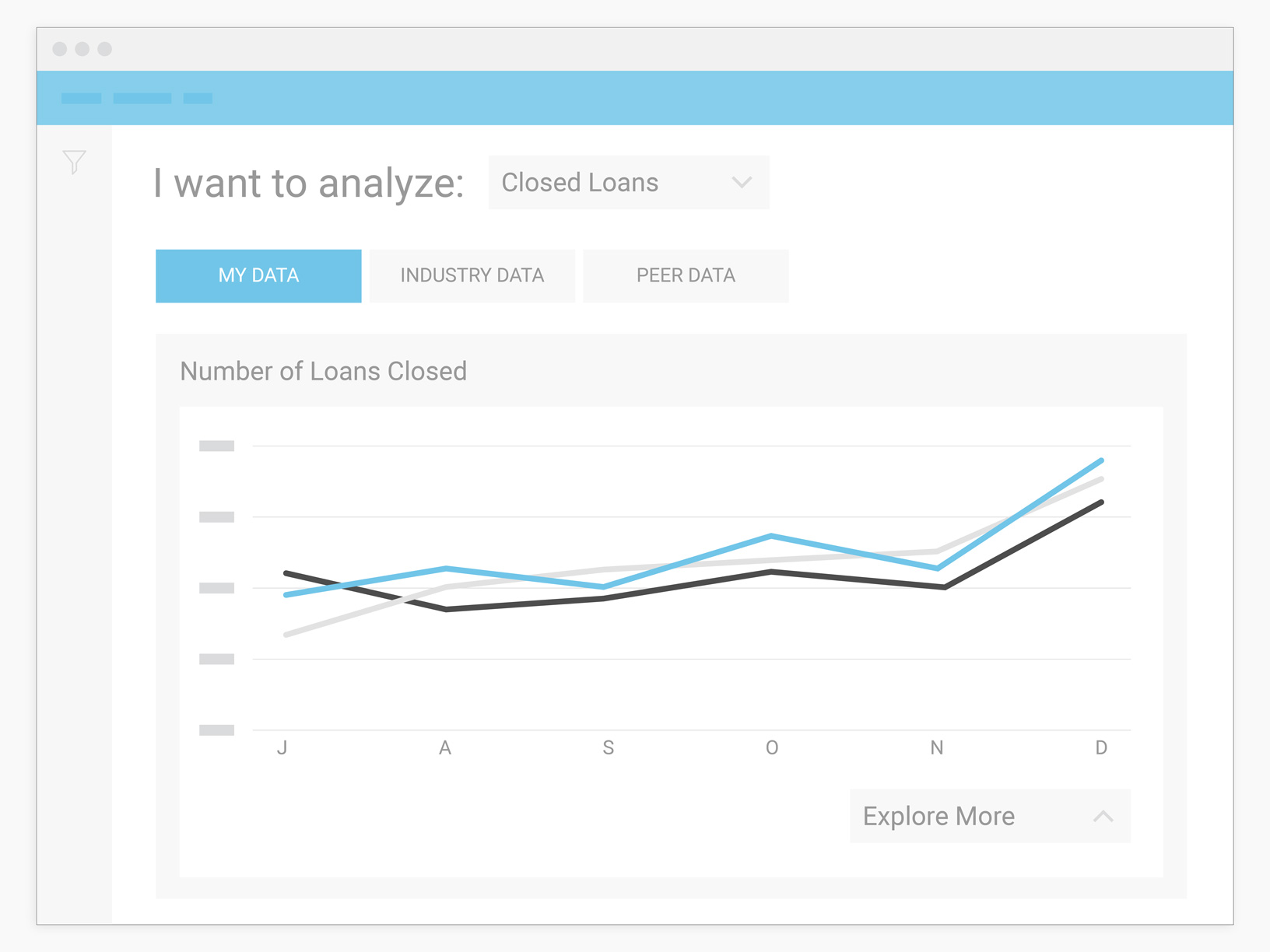

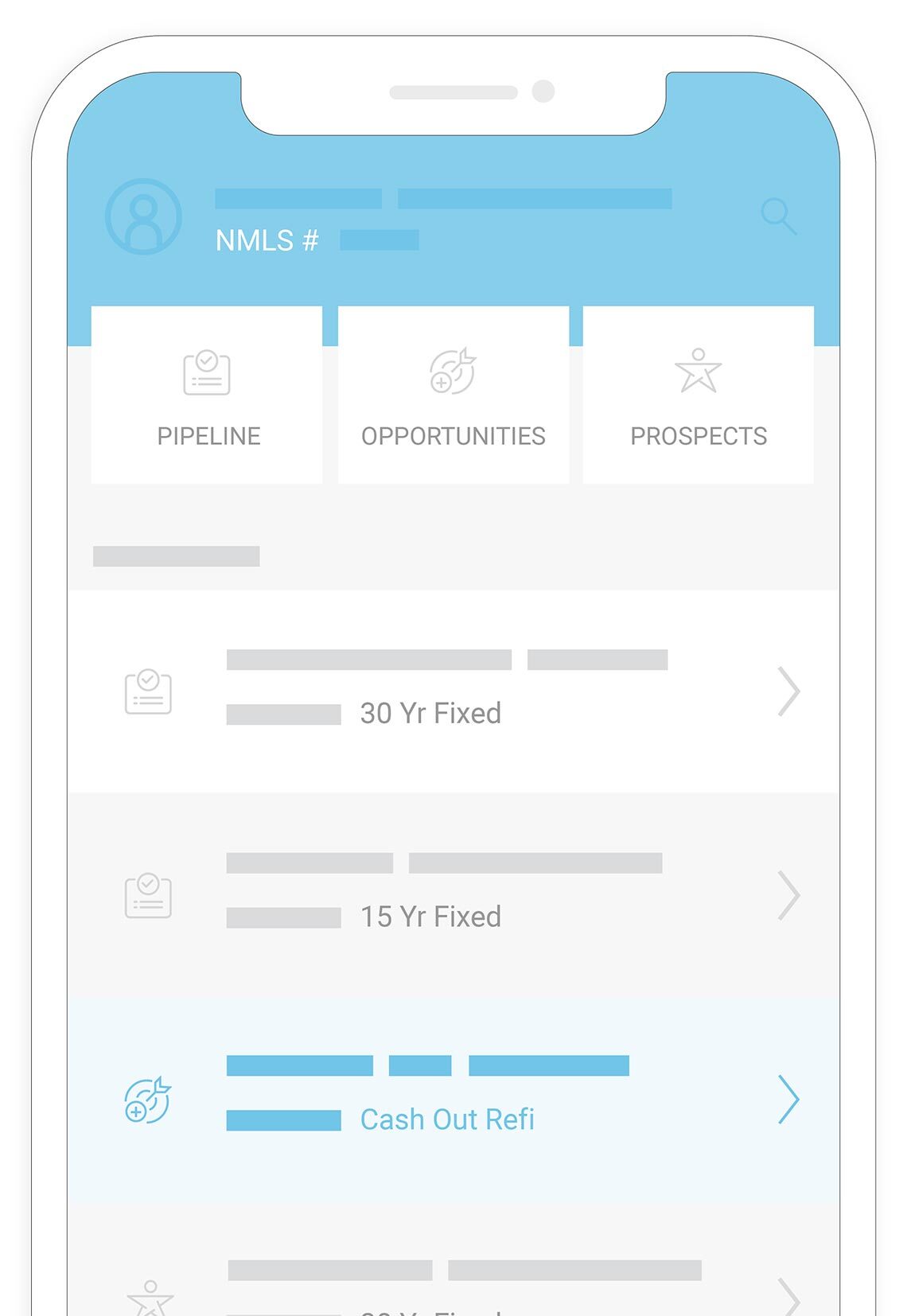

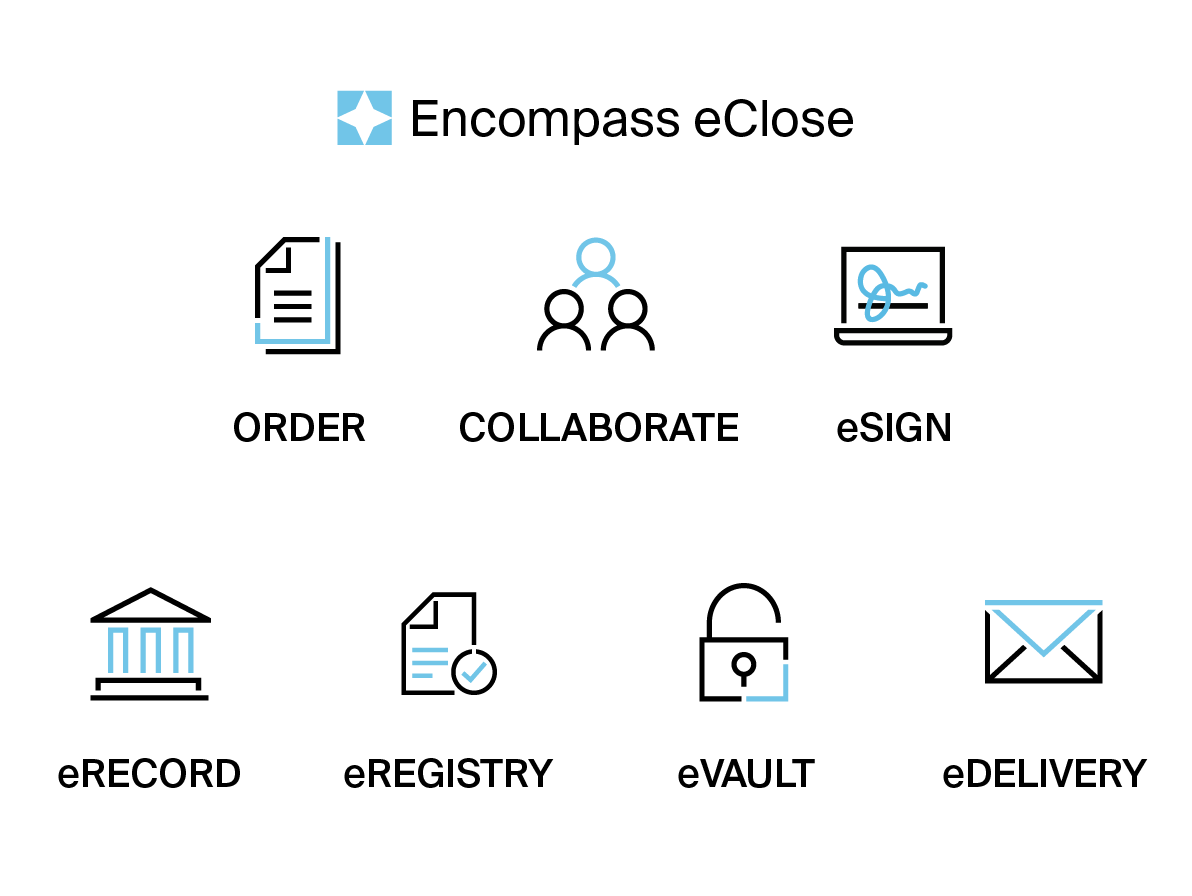

Eliminate complexities and lower the cost of lending and investing at scale. With Encompass® by ICE Mortgage Technology®, the industry’s only true end-to-end digital mortgage solution, you can acquire more customers and originate, sell and purchase loans faster - all from a single system of record.

GET STARTED Learn more